Bitcoin Vs The Australian Dollar and Australian Property

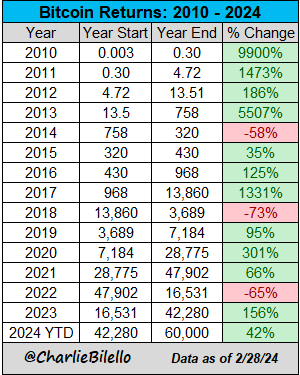

The Australian Dollar has plummeted in value when measured against Bitcoin!

Why is this not front page news in every Australian newspaper?

The Australian Dollar can be printed up in unlimited quantities and paper money always returns to it's intrinsic value over time (which is zero). It's value is constantly being eaten away by the effects of inflation and money printing by the banks and the Australian Government.

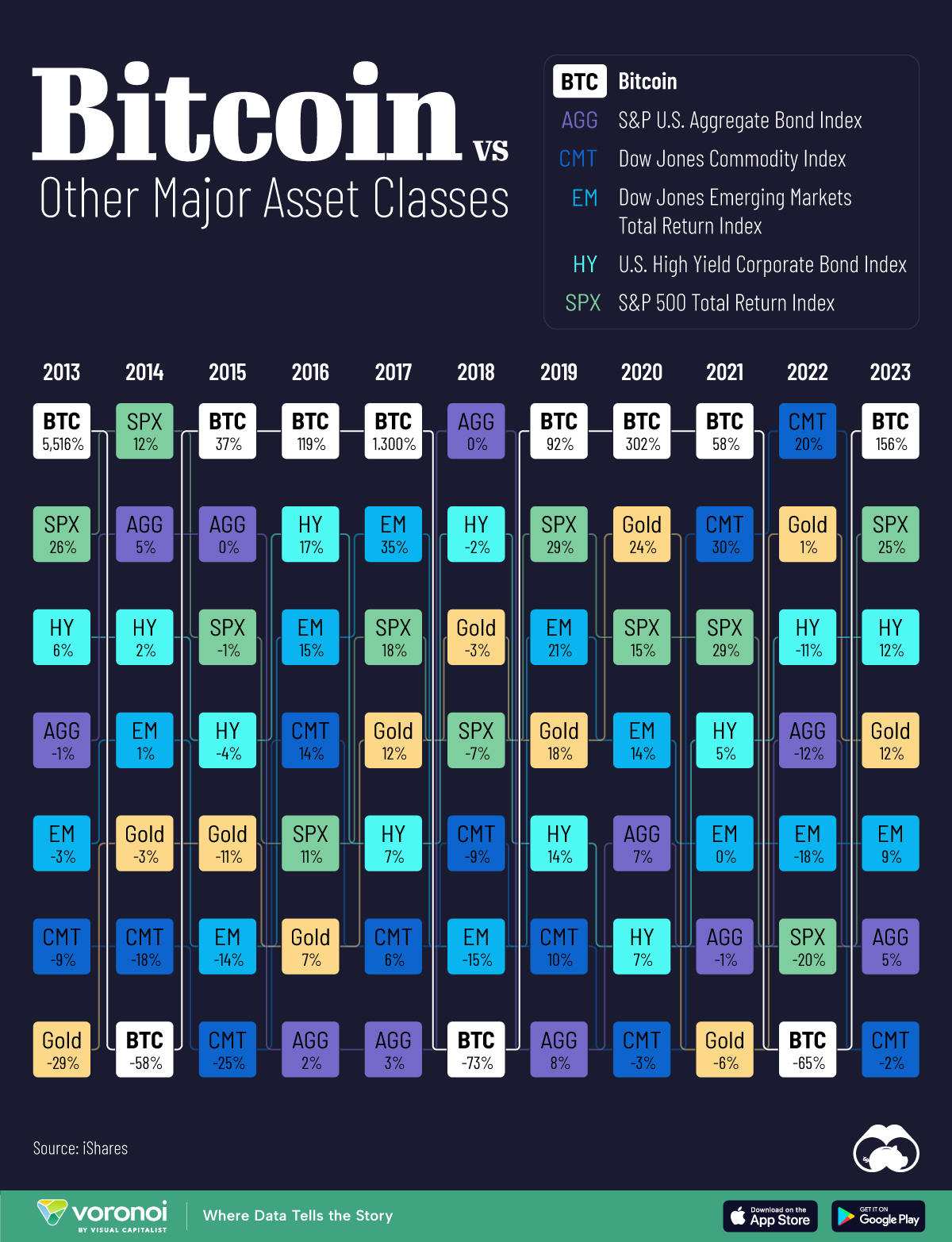

Bitcoin in comparison is a decentralized digital currency, is fixed in supply and is the best store of value compared to every other asset on earth and is a highly effective hedge against inflation. The Australian dollar, like every other fiat currency will continue to be inflated away due to money printing by the banks and the Australian Government.

Bitcoin's extreme scarcity is a key factor in its value appreciation. Unlike fiat currencies that can be printed away, Bitcoin has a limited supply capped at 21 million coins. This scarcity is built into the protocol and will not change, ensuring that Bitcoin cannot be inflated away like the Australian Dollar and every other traditional fiat currency.

Bitcoin's decentralized nature provides a level of security and trust that fiat currencies lack. With no central authority controlling Bitcoin, it's completely immune to government manipulation and interference. This independence from the government and the banks is very appealing, especially in times of economic uncertainty or when there are concerns about inflation and currency devaluation.

Bitcoin's growing adoption and acceptance as a form of payment via The Lightning Network and by people and instritutions for investment further support its continued value appreciation. As more individuals and institutions hone in on Bitcoins beacon and recognize the benefits of Bitcoin, its demand and value will increase and increase significantly in the years and decades ahead.

The Australian dollar will continue to face challenges such as inflation and money printing by the banks and the Australian Government. These actions will erode the purchasing power of the Australian dollar over time, making it less attractive as a store of value.

Bitcoin's scarcity, decentralization, and increasing global adoption make it not just compelling alternative but a necessary alternative to fiat currencies like the Australian dollar.

The Australian dollar will continue to face challenges from inflation and money printing. Bitcoin's unique properties position it as a fantastic hedge against these risks with its value continuing to increase relative to the Australian dollar and every other fiat currency out there.

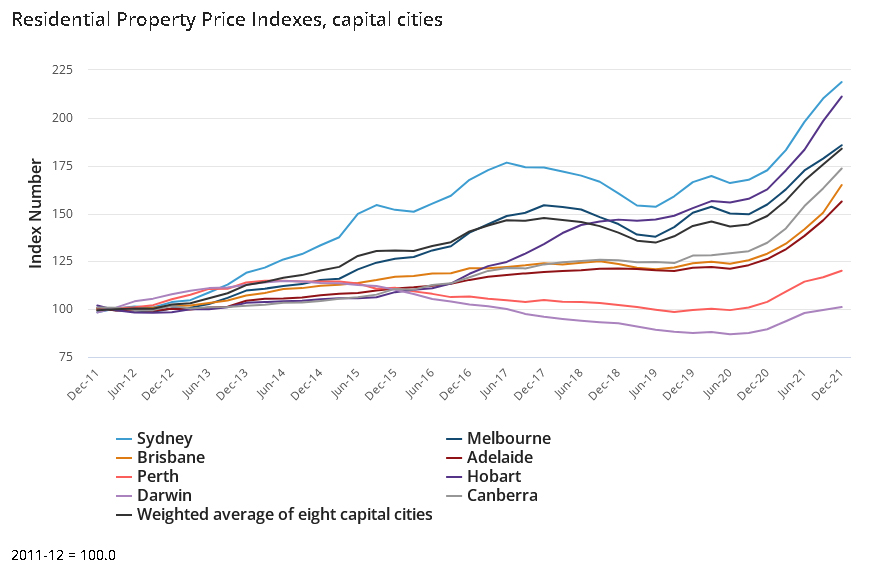

The latest figures as of 4th March 2024 are:

Sydney: 11.38 BTC

Melbourne: 9.32 BTC

As you can see - there has been a massive crash in property values relative to Bitcoin over the past 13 years.

Bitcoin has absolutely smashed the returns that Australian property has generated and will continue to do so. The table above (created March 1st 2024) highlights this.

Australian property has been a longstanding and much loved investment choice by Australians due to its historical increase in value over time. Owning property is The Great Australian Dream. The Australian property market has shown remarkable growth, especially in major cities like Sydney and Melbourne. One of the key factors driving this increase is the limited supply of land available for development, particularly in desirable locations. As population increases due to high immigration levels and urbanization continues, demand for Australian property has risen significantly, leading to higher prices. This has been compounded by the banks loaning ever greater amounts of money to people relative to their incomes for mortgages. Additional factors include "smart growth" and heritage protection and overlay policies which heavily restrict development in most inner and middle suburbs.

Property however is a variable asset because more can be created in response to increased demand. Developers can and do build new properties like apartments to meet the rising demand. The supply of property is not fixed, and can be adjusted to a large extent in response to market conditions. One need only look at the urban sprawl of cities like Melbourne for example to see that there is a large amount of new development. In addition brownfield sites and former industrial properties like many locations in suburbs like Port Melbourne have been redeveloped into luxury housing and apartments. Recent Victorian State Government changes allow three storey high apartment developments within the middle suburbs and we will soon see the face of the suburbs change significantly due to these new rules on infill development.

On the other hand, Bitcoin is a unique and unprecedented asset in that it has a fixed and not a variable supply. There will only ever be 21 million Bitcoins in existence, making it the world's only monetary asset with a fixed supply that cannot be increased over time in response to an increase in demand. This fixed supply is enforced by the Bitcoin protocol and is one of the key features that sets Bitcoin apart from traditional fiat currencies and every other asset on earth. No government (or anyone else for that matter) can mess with the rules of the Bitcoin protocol either. Government is forever meddling in the housing market which makes housing a highly political investment which is subject to whatever changes the Australian Government wants to make and whatever new policies they want to implement which greatly mess with housings supply and demand ratio and hence it's value. It's interesting to think about this - all housing is local but Bitcoin is a global monetary asset on the world stage.

Bitcoin's supply is further constrained by the block reward halving that occurs approximately every four years. This event reduces the rate at which new Bitcoins are created, effectively decreasing the rate of supply growth. As demand for Bitcoin continues to increase, driven by factors such as its store of value properties, growing acceptance, and adoption, the decreasing supply growth will lead to further price appreciation.

Australian property and Bitcoin represent contrasting approaches to supply dynamics in response to changes in demand. While property can be created to meet increasing demand, Bitcoin's fixed supply and decreasing supply growth due to halving events make it a unique and valuable asset in the long term.

Contact Mr. Bitcoin

If you're interested in Mr. Bitcoins services please contact Clarke today and he will help you!

Bitcoin Links

- View/Rate Clarke's Services

- Digital Assets Glossary

- Thai Bargirl Bitcoin Services

- Live Cryptocurrency Prices

- Pay Clarke for Bitcoin Consultation

- The Pride of Our Footscray Community Bar Share Sales Platform

- Sign up to receive the INTJ Billing Newsletter

- Clark Moody Bitcoin Dashboard

- INTJ Billing Status Page

- INTJ Billing Thai Bargirls Bitcoin Project - All Forms Page (Protected)

- INTJ Billing Thai Bargirl Clients with custodial and non custodial Bitcoin Wallets (Protected)

- INTJ Billing Thai Bargirl Clients Upload your Identification card to a secure area (encrypted)

- Buy Bitcoin from INTJ Billing to send to a Thai Bargirl in Thailand

- Request a Bitcoin Wallet be set up for your Thai Bar Girl friend in Thailand

- Thai Bar Girls Request a Bitcoin Wallet for yourself using this link

- BitPay Website

- BitPay Wallet Android

- BitPay Wallet iPhone

- Siam Secure Pattaya Thailand

- BTCPay Server is a self-hosted, open-source cryptocurrency payment processor. It's secure, private, censorship-resistant and free

- Buy Cryptosteel Capsule

- Buy Ledger Nano X

- The Night Wish Group